It’s now year-end and following that, your auditors will pay a visit. In this post, we will discuss all things related to closing your year in Business Central.

Preparing for a Year-End Close

There are a few things generally need to be done:

- General ledger Allow Posting From and To Dates

- Possibly Deferral From and To Dates

- Probably some User Setup From and To Dates

- Create new Accounting Periods

- Close prior year Accounting Periods

- Close Income Statement

Number one on this list is not new. It should be something that you are doing every month. A best practice is to set your general ledger posting from and to dates for the current calendar month. This then is the range that all users must adhere to and the system will verify posting dates fall within. User Setup should only have your accounting personnel and be set to the smallest amount of months possible. Try to make this last month and current month; don’t leave it open for the entire year, as accountants make mistakes just like everyone else. If using Deferrals, your date range could be one year into the future, or two or three, depending on your prepaid expenses or prepaid revenue.

The next two items are things that you do very infrequently, maybe once per year. If you’re anything like me, remembering the steps from last year can be a struggle.

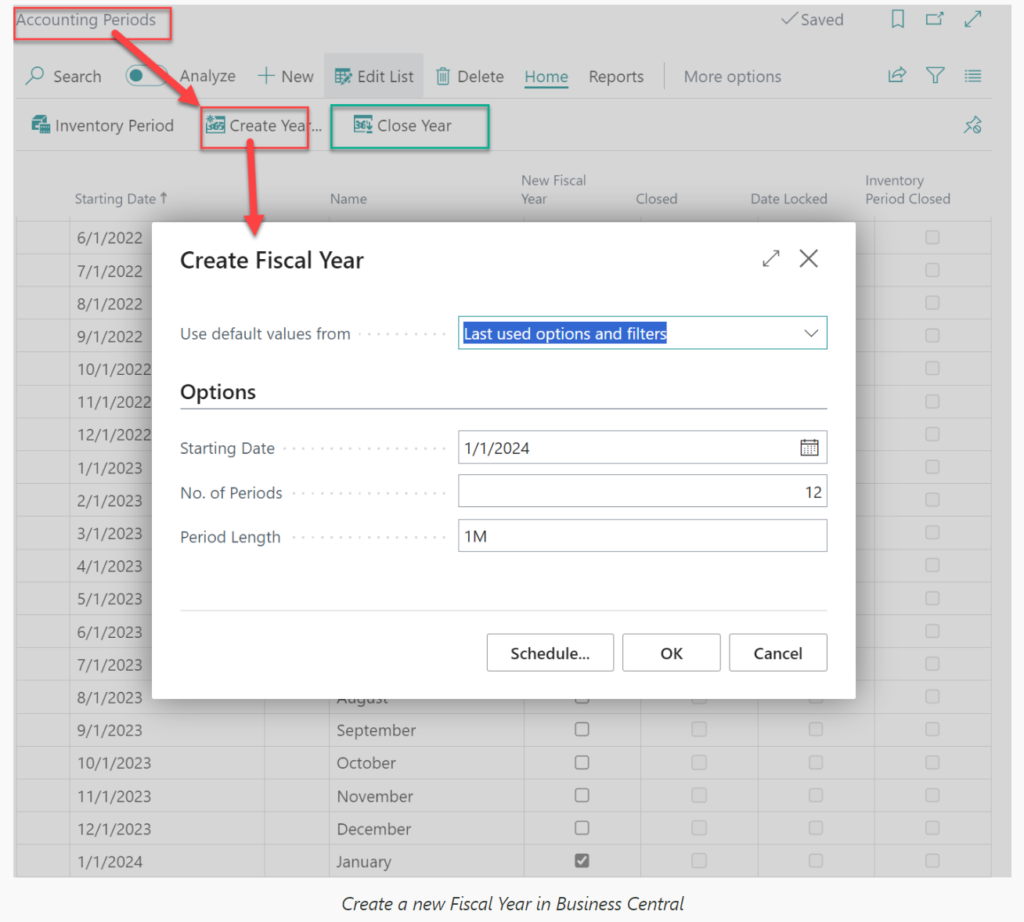

Creating a New Fiscal Year in Business Central

For accounting periods, you or your partner may have created periods that are many years into the future and that is absolutely okay. If you need to create the new year, here are the steps:

- Search for Accounting Periods

- Create Year (noted in screenshot below with red accents)

- Starting Date should auto populate for you

- No. of Periods defaults to 12

- Period Length to 1M

- If you are on a twelve month fiscal year and monthly basis, this works perfectly.

- If you are 4-4-5 or use 13 periods, you will need to make changes.

- For 13 periods, change No. of Periods to 13 and Period Length to 4W.

- For 4-4-5, I recommend accepting the defaults and then editing the start dates for each period.

- Close Year (notes in screenshot below with green accent)

- This only checks the closed column and the date locked columns

- This does not prevent entries from being posted to the closed dates

- Refer to General Ledger Setup and User Setup for posting date control

Fairly simple, right? Your system will function without accounting periods. However, you cannot use the date shortcuts of P1, P2, etc. Financial reports may have issues depending on how they are defined.

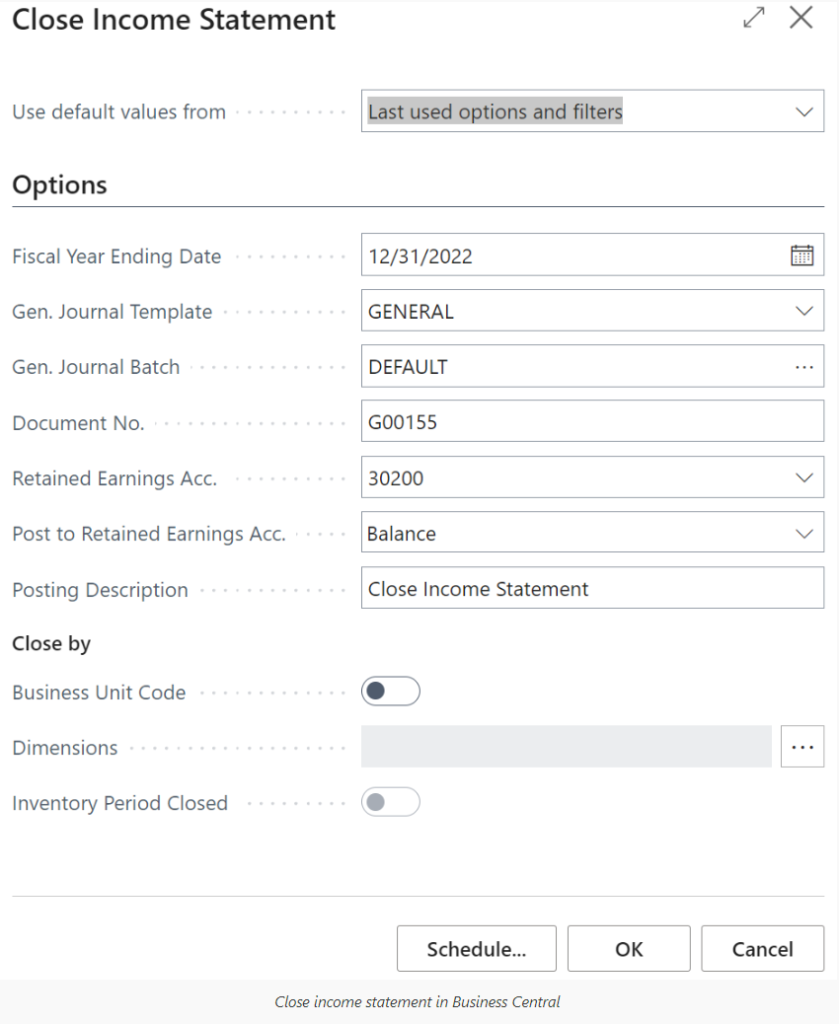

How to Close an Income Statement

After you close the last month of your fiscal year, it’s time to close your income statement. This process takes all income statement-type general ledger account balances and rolls the net income/loss into retained earnings. It is recommended that you close the income statement immediately after closing your last period; do not wait for audit adjustments. Audit adjustments can be entered when received, or however many months it takes to complete the audit. You simply enter the adjustments to the last day of your last period and re-close your income statement. Here’s a list of best practices and steps for performing the close income statement:

- Verify that balance sheet accounts all show the account type as balance sheet and income statement accounts are set to income statement. This is important because a balance sheet account marked as income statement will be included in the retained earnings calculation and an income statement account marked as balance sheet will not be included in the retained earnings calculation.

- Make a note your net income or loss amount.

- Run close income statement (see screenshot below)

- Year beginning closed should default. If this is incorrect, you have not closed the accounting periods for the year.

- Gen. Journal Template should be set to General.

- Gen. Journal Batch set to a name of your choosing.

- Document No. set as desired.

- Retained Earning Acc. is the general ledger account for retained earnings.

- Post to Retained Earnings set to Balance.

- Posting Description set a desired.

- In a consolidation company, you should close by Business Unit.

- You can close by dimension but this is not required, some reporting requirements may need dimensions closed.

- Verify journal’s amount being posted to retained earnings is the amount from Step 2.

- Post journal.

- Verify your retained earnings account balance is as desired.

And that’s it!

All entries posted from the Close Income Statement process are posted with a Cdate; for example C12/31/2023. The “C” stands for Closing or Closed. When running comparative financials year over year, the Cdates are not included. If you want a report to include the Cdates, you must include the date in your date filter.

Closing Thoughts

If something requires a new entry into your old year like audit adjustments, what do you do?

- Simply set the User Setup to allow posting from to the desired date.

- Post your entry.

- Reset your User Setup dates.

- Close income statement, the new retained earning amount should be the net income/loss from the entry just posted.

- Post the journal.

- Verify your retained earnings account balance is as desired.

Onward for a great new year!