There are a handful of concepts intricately connected and are an absolute must for understanding how inventory transaction flows throughout the system, what is affected and how the subledger is connected to the general ledger.

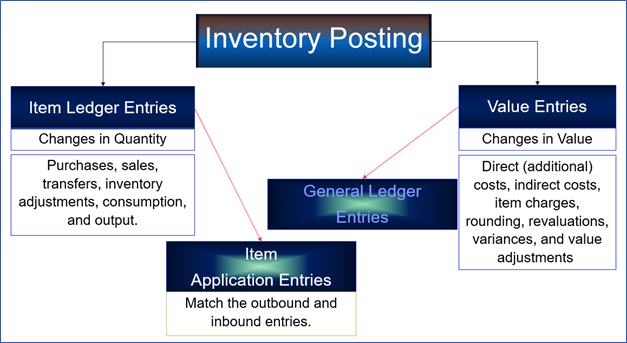

Posting an inventory transaction has three important pieces.

1) To track quantity, records are posted to the item ledger entry table

2) To track dollars relating to those quantity transactions, records are created in the value entry table

3) Entries to the general ledger all relate to the value entry table.

The following is a visual representative of these posting concepts.

A purchase invoice, when posted, adds quantity into inventory and the posting creates a value entry for the dollar amount of the transaction, additionally, the dollars create general ledger entries. Base NAV/BC debits a purchases account and credits accounts payable. If Automatic Costing Posting is turned on, secondary entries to credit the direct cost applied account and debit inventory are also posted. Please note that if Automatic Cost Posting is not turned on, the Adjust Cost routine is required to get the secondary entries.

For a sales invoice, quantity is deducted from inventory, a value entry for the cost of the inventory is made and the general transaction to credit inventory and debit COGS is created when Automatic Cost Posting is turned on. Without Automatic Cost Posting the cost of goods/inventory entries are made with Adjust Cost is run.

It is noteworthy, that you cannot take your value entries alone and calculate your average cost. Nor can you use value entries alone to understand inventory values. Recently, I’ve encountered users trying to do both of these types of analyses to justify their Excel value and to support very large accounting adjustments.

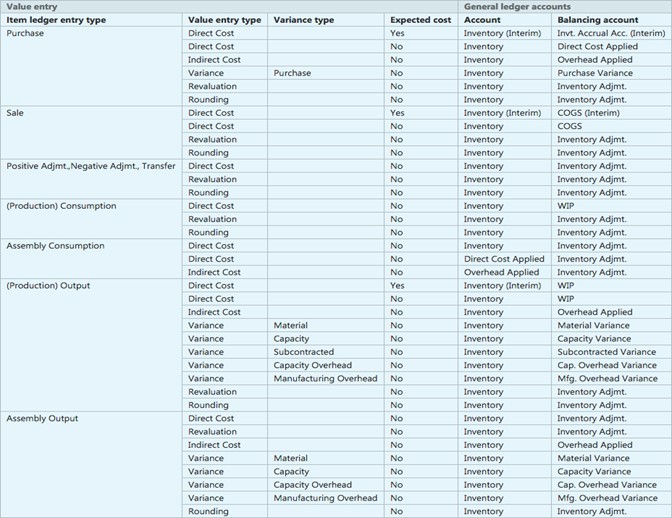

The two examples above do not take into account the expected cost accrual of purchase receipts and sales shipments. And no examples for manufacturing, assembly, purchase credits or sales credits have been shown. To see the various accounts that NAV uses in posting to the general ledger, the following chart is very helpful.

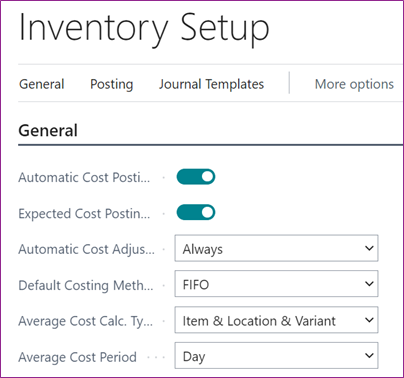

Another important concept relating to our inventory to GL reconciliation involves some settings in Inventory Setup. Most importantly is Automatic Cost Posting turned on, if it is not you must run the Adjust Cost – Item Entries program with the Post to GL checked. This is required to get the accounting entries for purchase, sales, production orders, adjustments, etc. posted. Settings for Expected Cost Posting and Automatic Cost Adjustments are very important and we’ll cover those in another chapter.

Furthermore, the automatic cost adjustment timeline can impact accounting postings. And if you are an average cost company, the average cost calculation type and period are settings important to what cost is updated and thus affects timing of changes in cost and inventory value.

What do you think Automatic Cost Posting does? Do you think it takes the place of Adjust Cost-Item Entries? The answer is that Automatic Cost Posting does exactly what the name says, when posting purchase and sale transactions the cost accounting entries are automatically posted. We gave the example for a sale for automatic cost posting, the debit to cost of goods and credit to inventory are posted to the general ledger. You would think that is just a standard feature, but way back years ago, costs were always posted when the Adjust Cost-Item Entries with Post to GL was executed. Also, this routine handles the situation were your purchase order has $1, you received it, sold it and the vendor now charges you $1.05. The five cent difference may need to partially stay in inventory and partially follow through the the sale already posted. Adjust cost creates the necessary accounting entries.I kn

I’ve heard it said many times, ‘I don’t have to run Adjust Cost because I have Automatic Cost Posting turned on.’ Though Automatic Cost Posting does execute Adjust Cost, it does not eliminate the need to run Adjust Cost, at least monthly. And if you do assembly or manufacturing, it’s a requirement to run. We cover this a little more in another Chapter.

Quick note: this set of blogs does not discuss costing methods. Of course, the item’s costing method defines what amounts are used in transactions but regardless of the amount, how and when the general ledger is impacted is what this series of articles covers.