This assisted setup step is to help enable reporting of the IRS 1096 in the NA version and provide an easy overview. As those in the US know the 1096 summarizes 1099s and is required to be filed with the IRS when using paper 1099 forms.

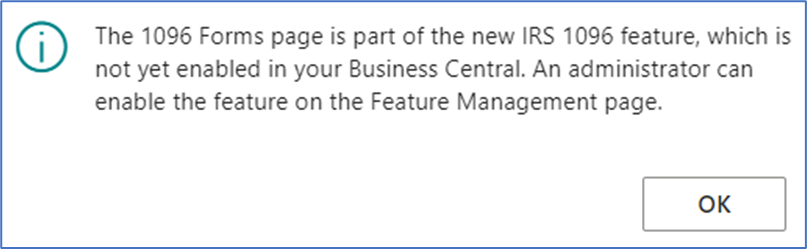

At first glance, the Read option under Learn More does not seem to provide any documentation from Microsoft that is helpful. However, the purpose of the documentation that is displayed is required because you have to enable the 1096 feature under Extension Management. If you do not enable this, you can complete the 1096 Setup Wizard but you still cannot utilize the 1096 forms. You will receive the following error message:

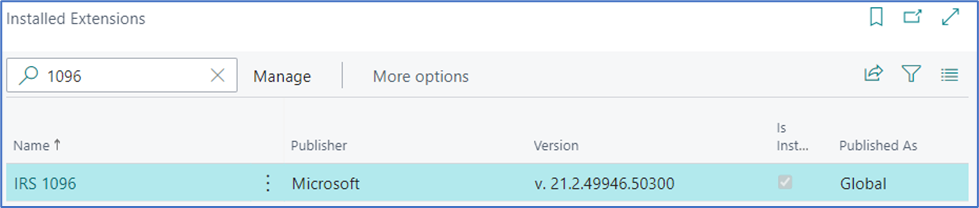

So check your extension management, make sure you have the IRS 1096 extension and it is installed. If not installed, you need to install the extension.

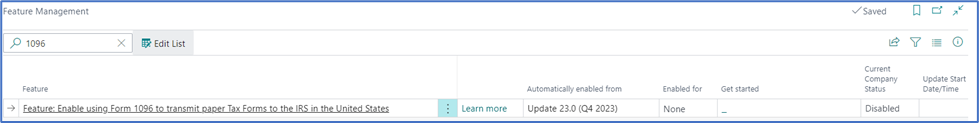

Once installed, the feature needs to be enabled, so proceed to Feature Management and find the Form 1096 feature. Reviewing ‘Learn More’ will show you the Microsoft documentation related to setup and use of the IRS 1099 tax form in the US version.

To enable, make sure you are in ‘edit mode’ and change the ‘Enabled for’ field from None to All Users. Note this will start the Same IRS 1096 Setup Wizard that Assisted Setup opens. Once the Wizard completes the ‘Enable for’ field changes to All Users.

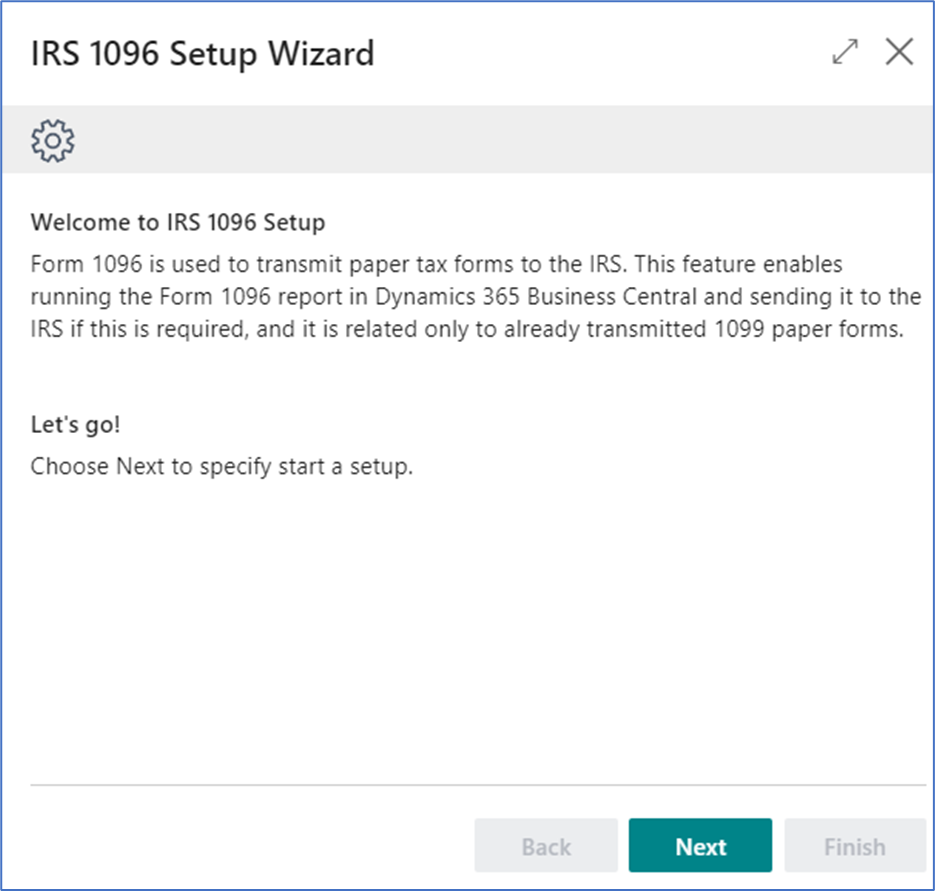

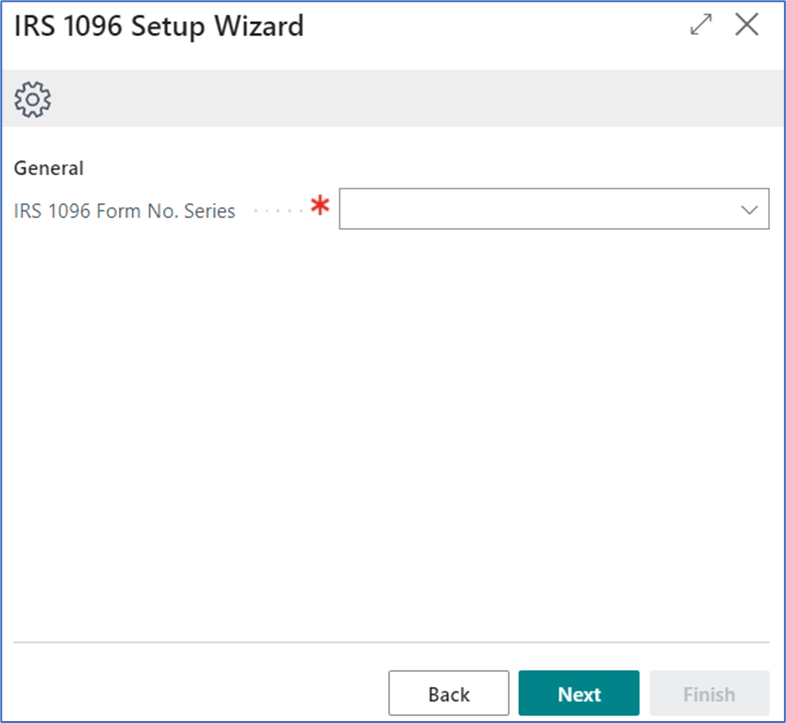

Let’s step through the IRS 1096 Setup Wizard:

The very first step in the wizard wants a No. Series. If this is your first use, you will need to setup a number series and select it. There is nothing special about the numbering but a number series is required.

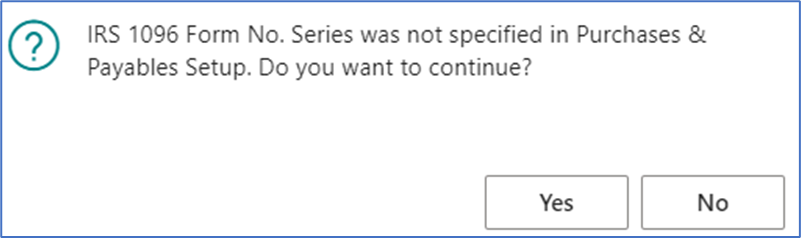

If you fail to provide a number series, you will receive the following error:

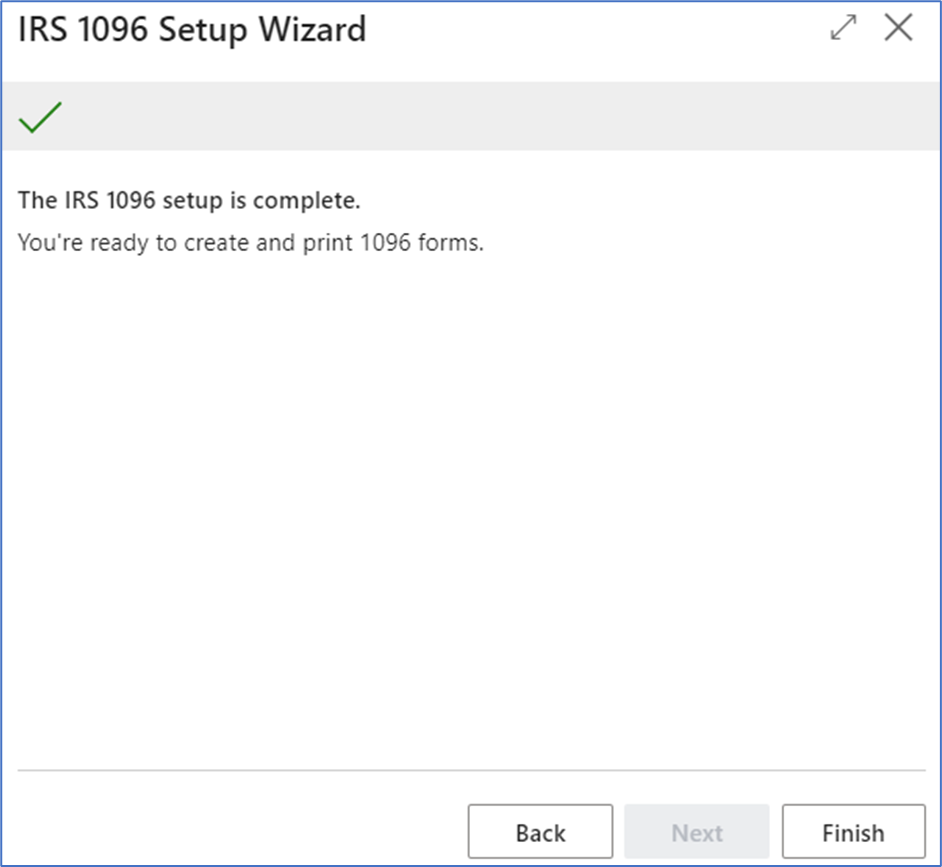

Once you populate the No. Series field and select Next, you are prompted for to Finish the Wizard.

Once you have processed invoices and payments to vendors with 1099 codes, you can review the 1096 form which will show an overview of 1099 information.

Remember 1099 data is based on invoices and credit memos and when the are paid. It’s actually the payment that is reviewed and traced back to the associated invoices and credit memos. This is important if you have to edit vendor ledger entries related to 1099 transactions after they are posted and paid. Do not edit the payment entries, it will not yield the desired results.