Ever been told ‘take a minute to do it right the first time’? This old adage keeps you from having to redo things over and over. And exactly what using deferrals in BC can do. Rather than having to remember to post recurring journals for all those prepaid expenses, why not process them when you enter the vendor invoice. Prior to BC version 20 (Release 2022 Wave 1), posting date range might have been a reason as you had to extend the allow posting to date to get deferrals posted into the future. This is not the case any longer.

Deferrals Setup

(Note: Release 2022 Wave 1 will have some date improvements in both Setup and in Transactional processing)

Accountants are very accustomed to those month-end journal entries to expense a portion of the various prepaid amounts. And it’s really irritating when someone forgets and no one catches it until the Financials get to upper management!

Let’s stop that from happening! Let’s get all the postings for the prepaid done when we enter and post the vendor invoice.

This quick blog, will walk through the setups needed for to use deferrals. A follow-up blog will provide transactional examples of using deferrals.

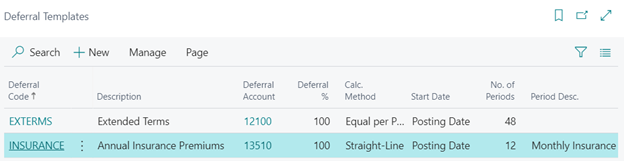

First, you need deferral templates. A template is something you can use over and over. So you could have a template for prepaids that are one year in length and another template for two year prepaids. However, if you like to edit descriptions so they are a little more explanatory, you might find it easier to have one template for each prepaid. Here’s a couple of deferral template examples.

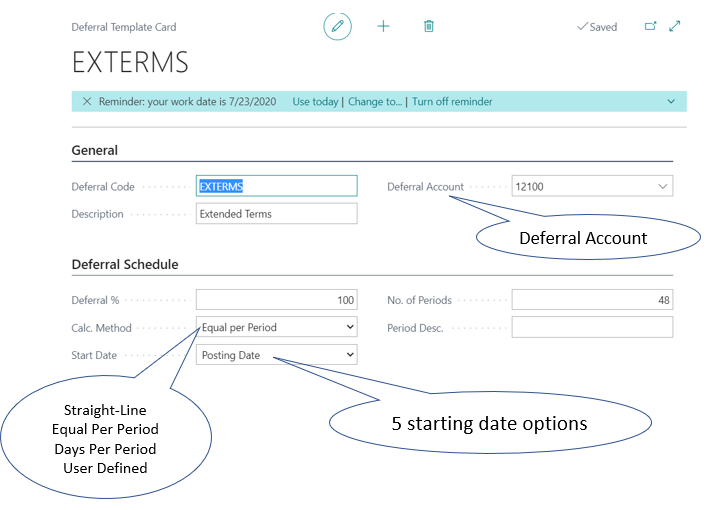

And the deferral card itself…

Deferral account is your balance sheet prepaid account. When you enter your vendor invoice, you will choose the expense account. BC uses the deferral account and the account from the invoice for the accounting entries to be posted for each period.

The amount of the posting is based on the Calc. Method. As you can see above there are four (4) options to choose from; the most commonly uses is Straight-Line which will prorate beginning and end months. The Equal per Period option is similar but will not prorate.

There are also five (5) starting date options; beginning of period and end of period are generally used. Test the various date options to see what works best for your organization.

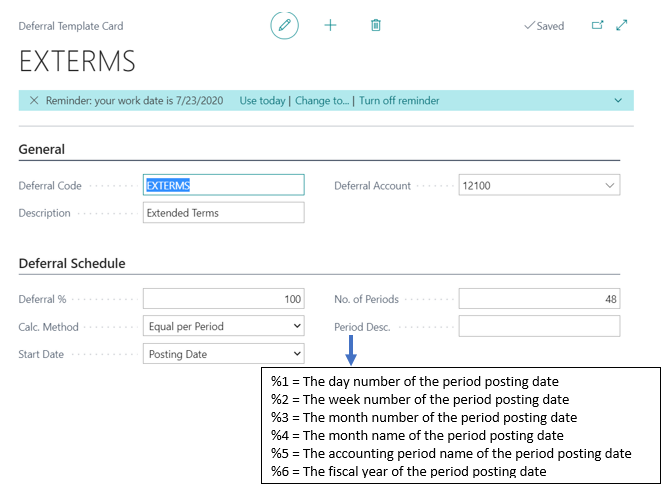

And for the description…

If populated as ‘%4 Insurance’, the description would post as June Insurance, July Insurance, etc. every time this deferral is used. So if this deferral code is not insurance, you have two options 1) setup two deferral template codes or 2) use a more general description where insurance is not part of the description. Personally, I would have more deferral templates.

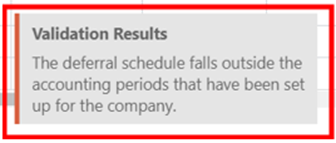

General Ledger Setup and User Setup have allowed posting from and to dates and in prior versions of Business Central these dates applied to Deferral postings as well as all other postings. Example: Working in May 2022, posting from 5/1/22 and Posting to 5/31/22, you try to post a 12 month prepaid/deferral expenditure means that User Setup Posting to date needs to be set to at least 4/30/23. When user tries to apply the deferral template in a purchase invoice, they will receive the following error:

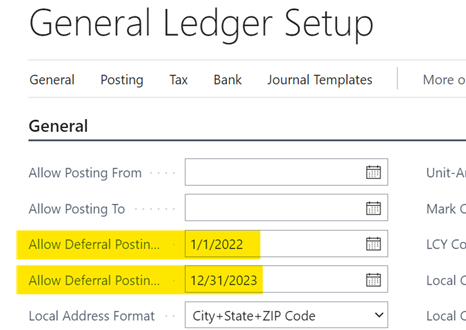

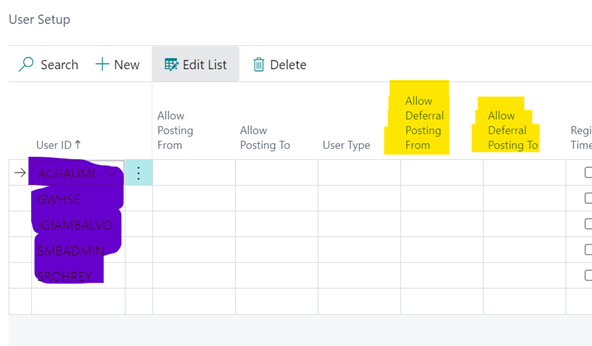

A new Release 2022 Wave 1 (version 20) feature allows for a different date range for posting of deferrals. Both the General Ledger Setup and User Setup have deferral allow posting from and to dates.

Now you can control the deferral date range separately from the rest of your accounting posting dates. This will allow for easier use of deferral in regular vendor invoice posting because you don’t have to open up a wide range of dates or remember to re-edit for a smaller range of dates.

If the Deferral Posting Date Range is not setup correctly, the same old error show above will appear when to are processing transactions.

You are not ready to move to Deferral Transactions!