So you use subcontractor work centers in routings for items that you produce and you find that the Planning Worksheet effectively creates your productions orders. Followed by the Subcontract Worksheet creating the associated purchase orders. Receipts from the purchase orders, create output entries against the production orders and life is good.

What happens to expected cost and actual cost of your finished item can be somewhat confusing and a bit frustrating.

We did a simple routing where the only work center was a subcontract work center because the entire process was outsourced. For our example, let’s say the work center has a $10.00 cost per item. For our components, let’s say the material cost from the BOM total $5.00 so our finished good should be $15.00. We are not using standard cost but rather LIFO.

Our production order has a unit cost on the order line of $15.00 which matches the finished good item/SKU card. The subcontractor purchase order has $10.00 as the unit cost which matches the item’s routing work center cost.

Ever find it confusing and hard to understand the flow of Accounting transactions through Expected Cost and WIP for Subcontracted work? I recently worked with a client that really struggled to understand and trace transactions, so I put together this analysis. I will share the information in written form and then add a quick spreadsheet recap.

Assumptions: Expected Cost is turned on, raw materials and finished goods use same inventory general ledger account and routing has only a subcontractor work center.

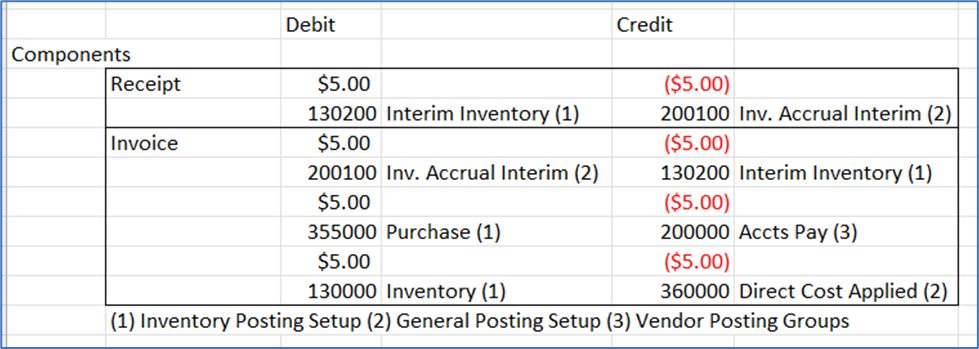

Components purchase from a purchase order through to vendor invoice is pretty simple and straight forward. Receipt will debit interim inventory account from Inventory Posting Setup and credit Inv Accrual Interim account (a liability account) from General Posting Setup. When the invoice posts, the receipt accrual is reversed, purchases account from General Posting Setup is debited, accounts payable account from Vendor Posting Group is credited, Direct Cost Applied account from General Posting Setup is credited and Inventory account is debited.

Consumption of components can be done is several ways and at different times based on the business processes. Consumption accounting entries debit WIP account from Inventory Posting Setup and credit inventory from Inventory Posting Setup.

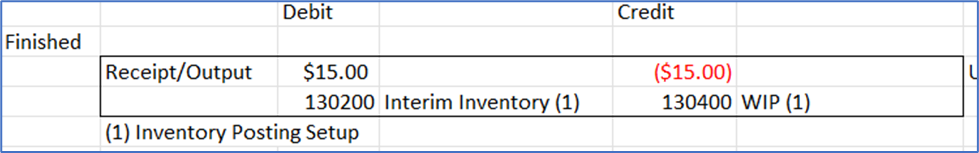

Finished item receipt from a subcontract purchase order is simple enough. Because the subcontract purchase order is created from the subcontract worksheet, there is a link between the purchase order and the production order. Receiving the purchase order creates an output item ledger entry. Interim Inventory account from Inventory Posting Setup is debited and the WIP account also from Inventory Posting Setup is credited. It’s important to know that though the purchase order unit cost is from the work center ($10 in our example), the accounting entry at receipt is for the full cost on the production order line which in our example is $15.

Note there is no accounts payable accrual like there is for component receipts.

Components have been purchased, vendor invoiced posted and consumed to the production order. Finished product has been received and output against the production order. There are two things have not happened at this point, the subcontractor’s invoice has not been posted and the production order has not been finished. And these last two things can happen in any order; invoice posts then order is finished or order is finished then invoice posts. The order affects the accounting entries.

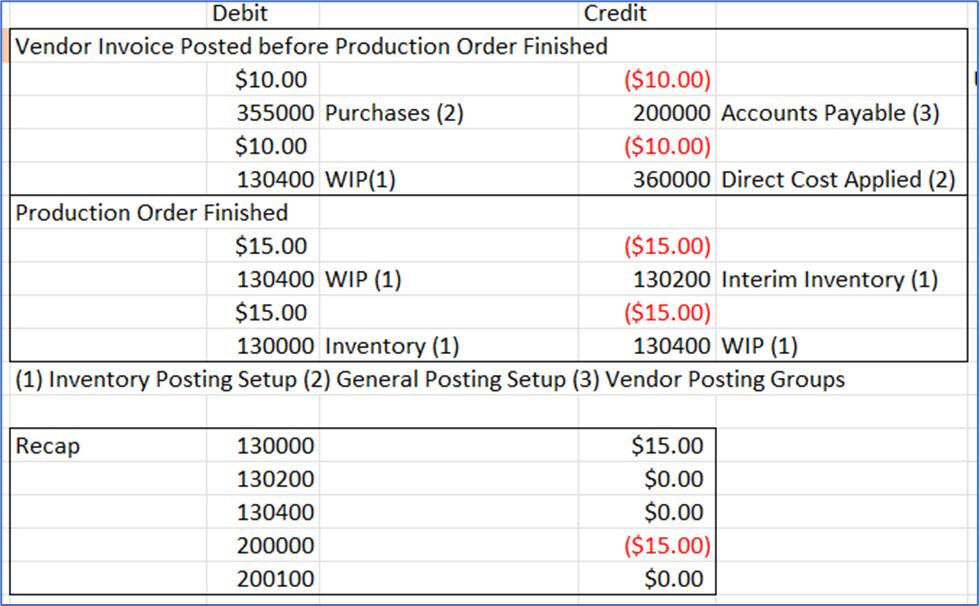

If the vendor invoice is posted before the product order is finished; the accounting entries for the invoice are a debit to purchases account from General Posting Setup, a credit to accounts payable from Vendor Posting Setup, debit to the WIP account from Inventory Posting Setup, a credit to Direct Cost Applied from General Posting Setup. The amount for our example matches the $10 cost on the purchase order. When the production order is finished all accounts used come from Inventory Posting Setup, the WIP account debited, Interim Inventory account is credited, Inventory is debited and WIP is credited. The amount for these inventory entries is $15 ($5 material/component cost) and $10 subcontract/work center cost.)

Notice the entries from all of the above transactions are shown in the Recap. We increased inventory by $15 (component purchase +$5, consumed component -$5, output finished item +15) and we have a liability for $15 ($5 for component and $10 to subcontractor.)

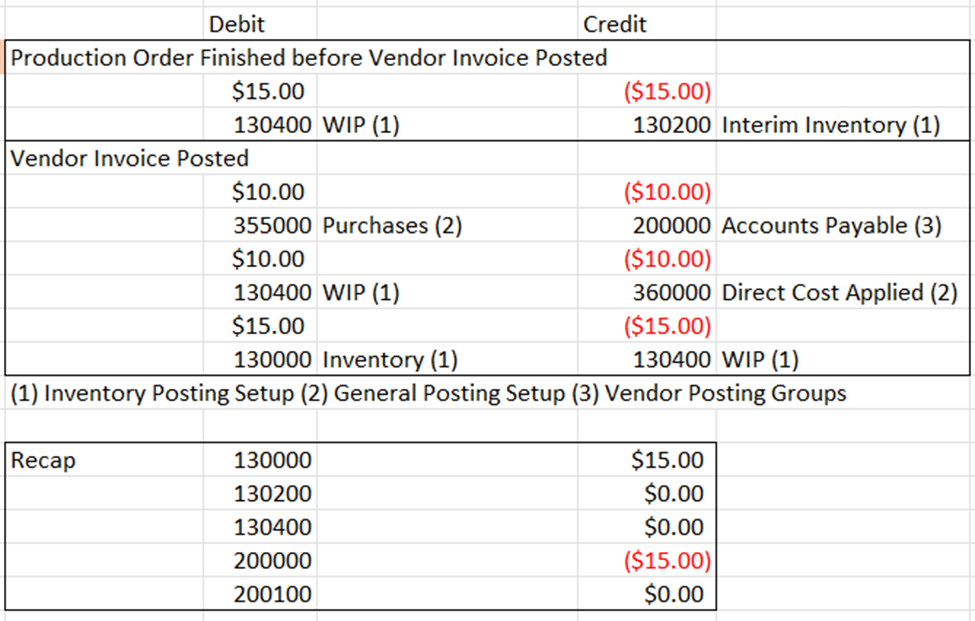

If the production order is finished before the vendor invoice is posted, the entries will be different. The production order will debit WIP and credit interim inventory with both accounts coming from Inventory Posting Setup. The Vendor Invoice debits purchases account from General Posting Setup, a credit to accounts payable from Vendor Posting Setup, debit to the WIP account from Inventory Posting Setup, a credit to Direct Cost Applied from General Posting Setup for the amount due to the subcontractor ($10) and debits inventory account from Inventory Posting Setup with an offset credit to WIP in the amount of ($15).

Note that the Recap entries are exactly the same if the invoice is posted before the production order is finished.

Hope this can be a reference and guide to help you understand the flow of accounting entries when dealing with expected cost, subcontract costs and WIP.

And one final note, since there is no accounting accrual for subcontract purchase order receipts, I recommend a timely running of the Reconcile AP to GL report filtered for all subcontracted purchase orders and use the total amount for an accrual. Timely is important as this report is pulled from purchase orders, if you wait for days into the new month, invoices and receipts posted will distort your accrual entry. You should be moving your General Ledger Setup dates into the new month late on the last day of the month are first thing on day one. With expected cost there is only the need for accounting personnel to post non-inventory payables into prior month.