I searched using Tell Me and it’s not there! I went to All Reports and it’s not there either! How do I review each vendor’s 1099 information? I’ve used this report for years and now what do I do?

Clients are calling and asking the same question. I thought about use the vendor ledger filtered for the year. Reviewing all invoices for 1099 code and 1099 amount to verify amount to be reported, eliminating entries with remaining amount since these are not paid. And looking at invoices in December to see if they were paid in December or January…but that’s a great deal of work for busy clients.

I took the vendor ledger entries for the year out to Excel, ran a pivot table to try to accomplish the above but there are so many things to consider to try to get to the right numbers.

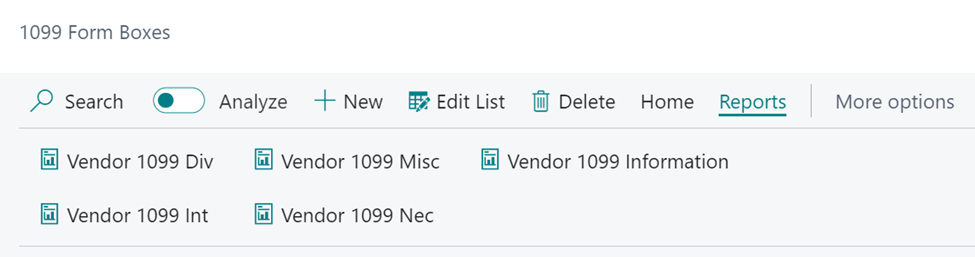

Alas, I reached out to the MVPs and other experts for what they are doing. Thank you to Cynthia Priebe who reminded me that it’s hidden: Go to 1099 Form Boxes and there is the report that I was looking for!

So, if you were concerned about losing the report, worry no more.

Cynthia also reminded me that any adjustments made through the Form Box Adjustment function are not included in the Vendor 1099 Information Report. The report only includes amounts recorded through the vendor ledger entries.

Since 1099 information is editable in vendor ledger entries, I have always done adjustments there. It’s important to remember that 1099 information is based on the document type of ‘payment’ and each payment is reviewed for the applied entries (invoices, credit memos, etc) to determine the 1099 amount. In other words, if you need to change amounts work with the invoices and credit memo vendor ledger entries.