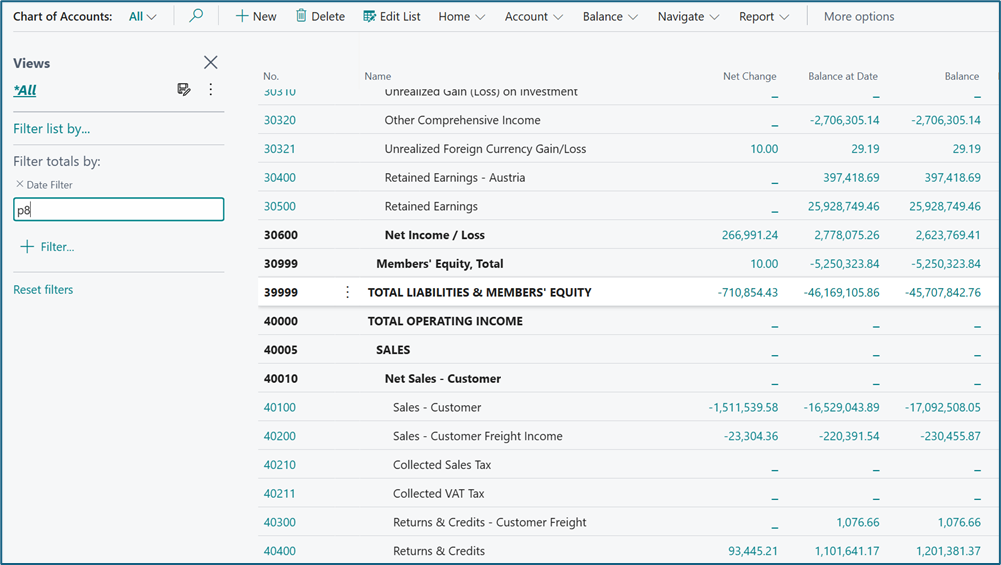

- Chart of Accounts List – Personalize to add the Balance At Date column. This column will give you the balance based on the last date in your Date Filter. Along with the Net Change column, you will have the two values that help you see Balance Sheet and Income Statement values with the date filter applied.

And get rid of various other columns that you find you are not using, which is most of them.

2. Though some users do not like headings, beginning totals, ending totals or total accounts in their chart of accounts; having an on-screen trial balance every time you open your chart of accounts list, is very helpful. Give it a try, these types of accounts will show as ‘bold’ so they are easy to see.

You cannot post transactions to these accounts, so don’t worry that they will accidentally be utilized.

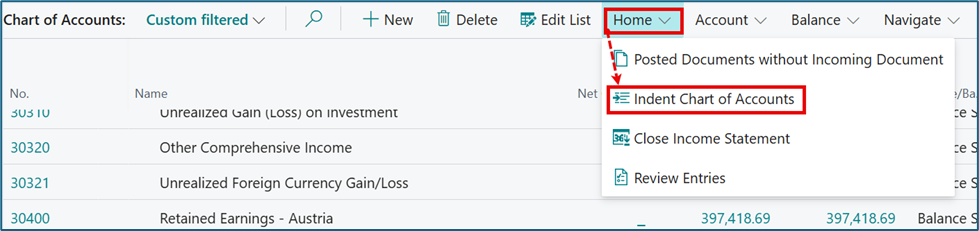

3. Use the Indent Chart of Accounts to make sure that all of your Beginning Totals have a matching Ending Total. Of course, this function also indents your account names. Don’t manually indent your accounts and don’t calculate the account ranges for beginning or ending totals yourself; let this function do the work. If you get an error, you need to correct some accounts and redo the indent until it runs without errors.

4. The typical miss in setting up a chart of accounts is that the Total Assets balance does not match Total Liabilities and Equity. This is caused because:

a. Current Year Earnings account does not exist or is not calculated correctly

b. And because Total Equity is not calculated correctly

c. And because Total Liabilities and Equity is not calculated correctly

How you fix is to do the following:

- Current Year Earnings should be a total account with a range of all income statement accounts

- Total Equity should be a total account with a range from the beginning of the Equity account through the last income statement account.

- Total Liabilities and Equity should be a total account with a range from the beginning of the Liabilities section through the last income statement account.

5. Use Account Categories and Subcategories to make selections in posting groups easier and to assist with financial reporting options.

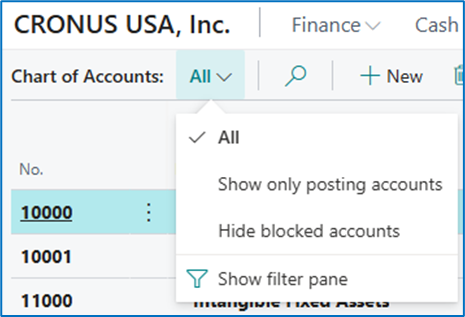

6. Use Saved Views without using the Filter Pane. This gives you more screen real estate for the fields and data that you really want to see. There are some prebuilt views, add your own to make this a super useful feature!

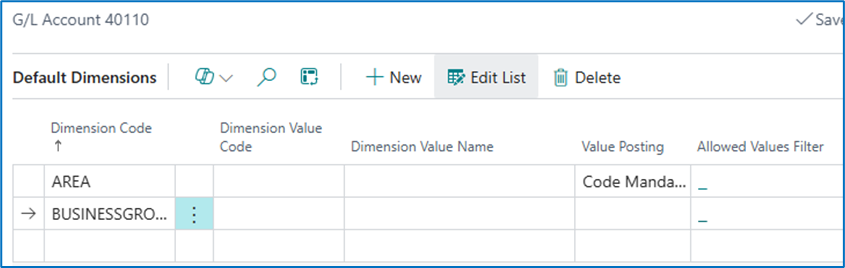

7. If you are using Dimensions, make sure that you are controlling the use of each dimension’s values at the chart of accounts level.

And you can set these controls from the chart of accounts list using the Dimensions-Multiple feature where you can select multiple accounts and multiple dimension settings to apply.

8. Remember that dimensions are not designed to be used as companies and will not keep data balanced by dimension values in the balance sheet. This is true if you process vendor payments for multiple companies but pay one vendor; the accounts payable entry can only have one company dimension.

9. Be careful not to overdue the number of dimensions. You want your dimensions to default from customers, vendors, items, resources, assets, projects, any time possible. Departmental expenses is one of those times where defaulting is probably not going to work well. Refer to #6 above.

10. Using dimensions on the balance sheet is a good way to keep your chart of accounts smaller. Like Notes Payable with values assigned based on a Note Name. Or Payroll Taxes with values assigned based on type of liability (wh, ss, unemployment, etc.) Use of a dimension called Accounting, can give you a wide range of uses on the balance sheet. It does conflict with our suggestions from #9 above. Refer to #7 above, this will allow you to use the same dimension and control the values based on the general ledger account number.

11.Each general ledger account has important fields that can assist you as you process transactions:

- Reconcile Account, lets you see what the balance will be after posting before you posting in journals

- Direct Posting, super important for subsidiary ledger controls (customer, vendor, item, bank, fixed assets at a minimum). This should be toggled off for any account with a subsidiary ledger

- Blocked, stop all postings to the account

- Omit Default Descr. In Jnl, helps you to remember to enter your own description.

12. Don’t forget to familiarize yourself with the Balance options, the Navigate options and report options from the Chart of Accounts list.

Looking for a way to do a task faster, more efficiently or just find a feature. Reach out and ask! There are so many features in Business Central that it’s hard to touch on each of them! But don’t let that stop you, keep searching and asking!