(Note: Release 2022 Wave 1 will have some date improvements in both Setup and in Transactional processing)

Be sure you’ve read the Deferrals Setup and have worked through the steps. As transactions are to be processed.

The examples in this blog use purchase transactions but the same functions and features apply to sales transactions as well.

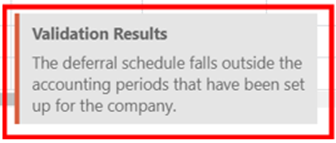

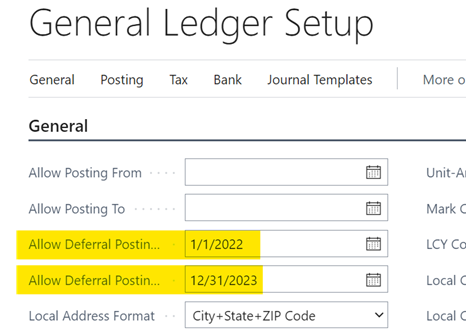

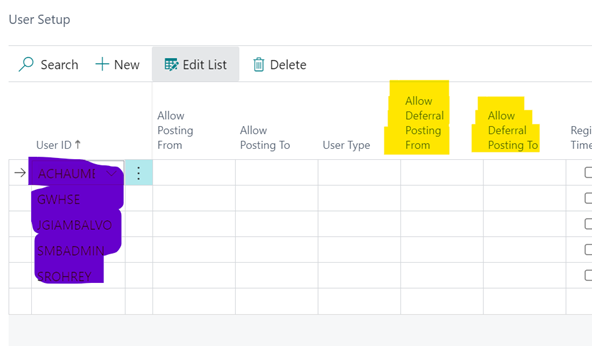

Remember to handle your General Ledger Setup and User Setup have allowed posting from and to dates. Example: Working in May 2022, Posting from 5/1/22 and Posting to 5/21/22, trying to post a 12 month prepaid/deferral expenditure means that User Setup Posting to date needs to be set to at least 4/30/23. If your Deferral Dates are too narrow, when user tries to apply the deferral template in a purchase invoice, they will receive the following error:

We covered in the Setup Blog the new allowing for a different date range for posting of deferrals. Both the General Ledger Setup and User Setup have deferral allow posting from and to dates.

If the Deferral Posting Date Range is not setup correctly, the same old error show above will appear.

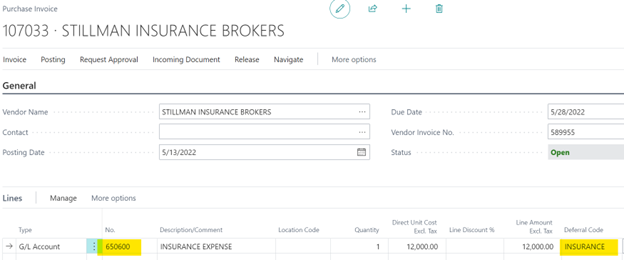

Standard purchase invoice is the next step in the process. Two typical changes to user steps are 1) the account number is no longer the prepaid expense account but now is the actual expense account and 2) entry of the deferral code.

The simple process of entering the deferral code, will create a deferral schedule.

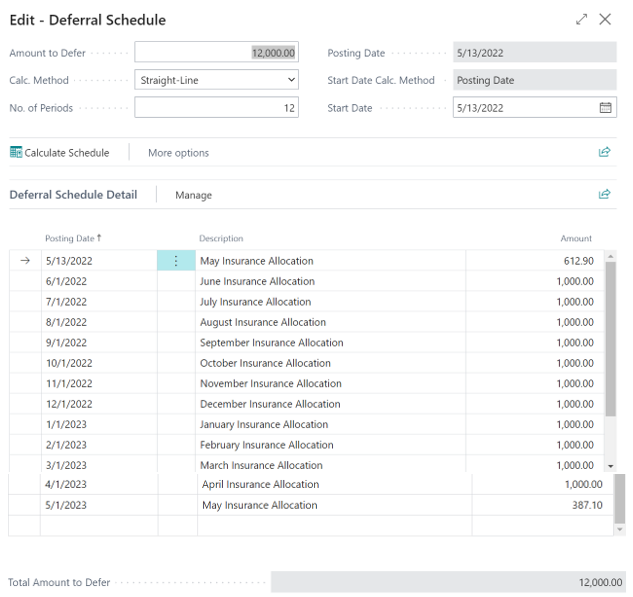

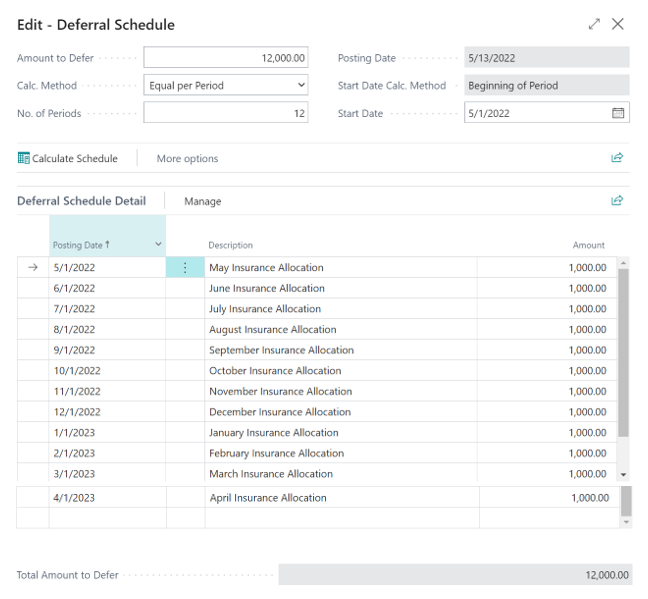

The deferral code template used in this example is setup as straight-line calculation and posting date. These two settings combine to have the system calculate and proration from the posting date. Below is an example of equal per period calculation method and beginning of period for start date.

Note: In both of the above examples, the description is using the month name and the period description from deferral template record.

Before I forget, if you want to change dates or amounts in the Deferral Schedule Detail on a particular invoice, you have the ability to override in the above screen shot.

When the invoice is posted, the general ledger accounts affected are the following:

Expense account entered on the purchase invoice line is debited and Accounts payable is credited using the posting date.

Expense account is credited and the prepaid expense account, from the deferral template, is debited, again using the posting date.

Each month the expense account is debited and the prepaid expense account is credited.

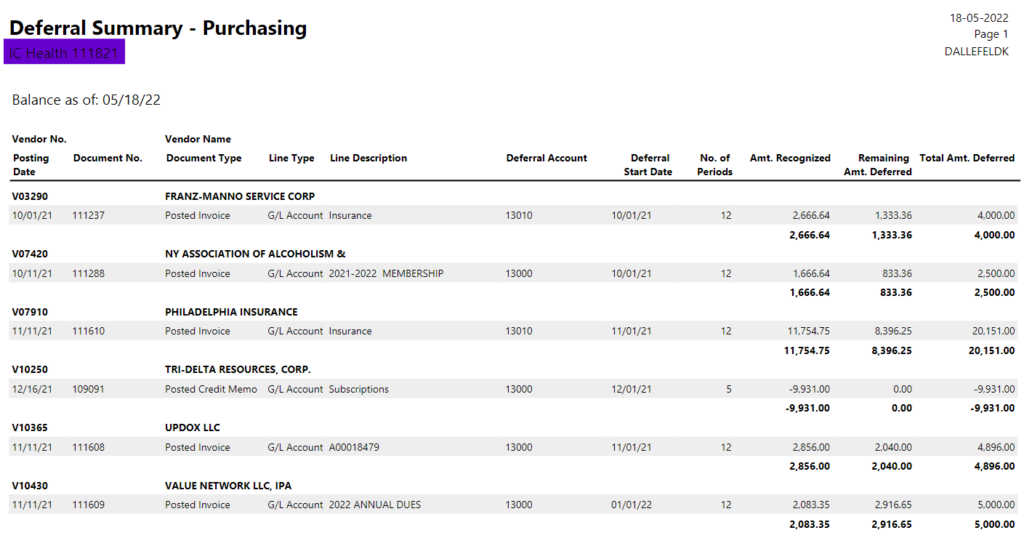

And reconciling those prepaid accounts is easy with both summarized and detail deferral reports.

No Recurring Journal each month is required!!!!

We only covered prepaid, vendor deferrals in our transactions. There are sales deferrals also that work the same way. You can even setup general ledger entries with deferrals….writing of some inventory over several months? Make your journal entry with the desired amount, expense account and deferral code and forget it….Deferrals will handle it for you! Do it once and forget it! Nothing to remember each month end—well one less thing to remember!